The state of New Jersey has recently provided extra financial help for dependents of deceased essential workers. On April 19, 2021, Governor Phil Murphy signed a new bill into law that modifies the weekly supplemental benefits paid to surviving dependents of essential workers who contracted the Coronavirus (COVID-19) while at work. The bill, S.B. 2476, was initially sponsored by Senators Troy Singleton and Dawn Addiego and was designed to help essential workers who continued on the job throughout the pandemic and during the most dangerous times.

How can Families Obtain the Supplemental Death Benefits?

When essential workers contract COVID-19 through their work activities and die of the disease, their dependents would normally be entitled to death benefits. This new law will provide supplemental benefits to these dependents as long as the following conditions are met:

- The deceased employee must be considered an essential employee under New Jersey law.

- There must be a Division of Workers’ Compensation dependency award court order.

Once this happens, the supplemental benefits will be paid to the dependents from the Second Injury fund. If the dependency benefits were initially voluntarily paid without a court order, which sometimes can occur, a claim petition must be filed on behalf of the dependent in order to convert the voluntary payment to a dependency order under the new law. The new law provides for a cost of living adjustment to the benefits.

What is an Essential Worker?

The law provides for a definition of essential workers and lists what categories of jobs will be subject to the increased benefits. Essential employees are as follows:

- Public safety workers or first responders including police, firefighters, and emergency medical staff.

- Medical and other health care services, emergency transportation, social services, and other care services, including services provided in health care facilities, residential facilities, and homes.

- Employees who perform services that are for the health, safety, and welfare of the community, who also work closely with the public. This definition will broaden the essential worker definition to include jobs that provide food, medicine, fuel, and supplies for conducting essential businesses.

Who is a Dependent of an Essential Worker?

Normally, when a worker dies on the job, the Workers’ Compensation law provides for death benefits to be paid to the deceased worker’s dependents. This death benefit is calculated based on the deceased employee’s wages. Following are the categories that qualify a family member as a dependent:

- A surviving spouse who lived in the deceased workers’ household at the time of the death. The spouse will be paid benefits for 450 weeks, that is, unless they remarry. Once the deceased’s spouse gets remarried, the dependent benefits will stop.

- The deceased’s children who are under 18 or under 23 years of age and a full-time student are also considered dependents and will receive dependent’s benefits until they turn either 18 or 23, respectively. The children must live in the deceased’s household at the time of the death.

- If a spouse or child was not living at the deceased’s household at the time of death, the spouse or child must prove that they were still dependent on the deceased worker’s salary for living expenses. This could also include dependents such as parents and siblings.

- Physically or mentally disabled dependent children are entitled to additional death benefits under New Jersey’s Workers’ Compensation law, including benefits lasting up to 450 weeks.

- Civil union partners.

The new law will make sure dependents of essential workers who have contracted the COVID-19 virus while working and died of complications of the virus will receive yearly cost of living adjustments.

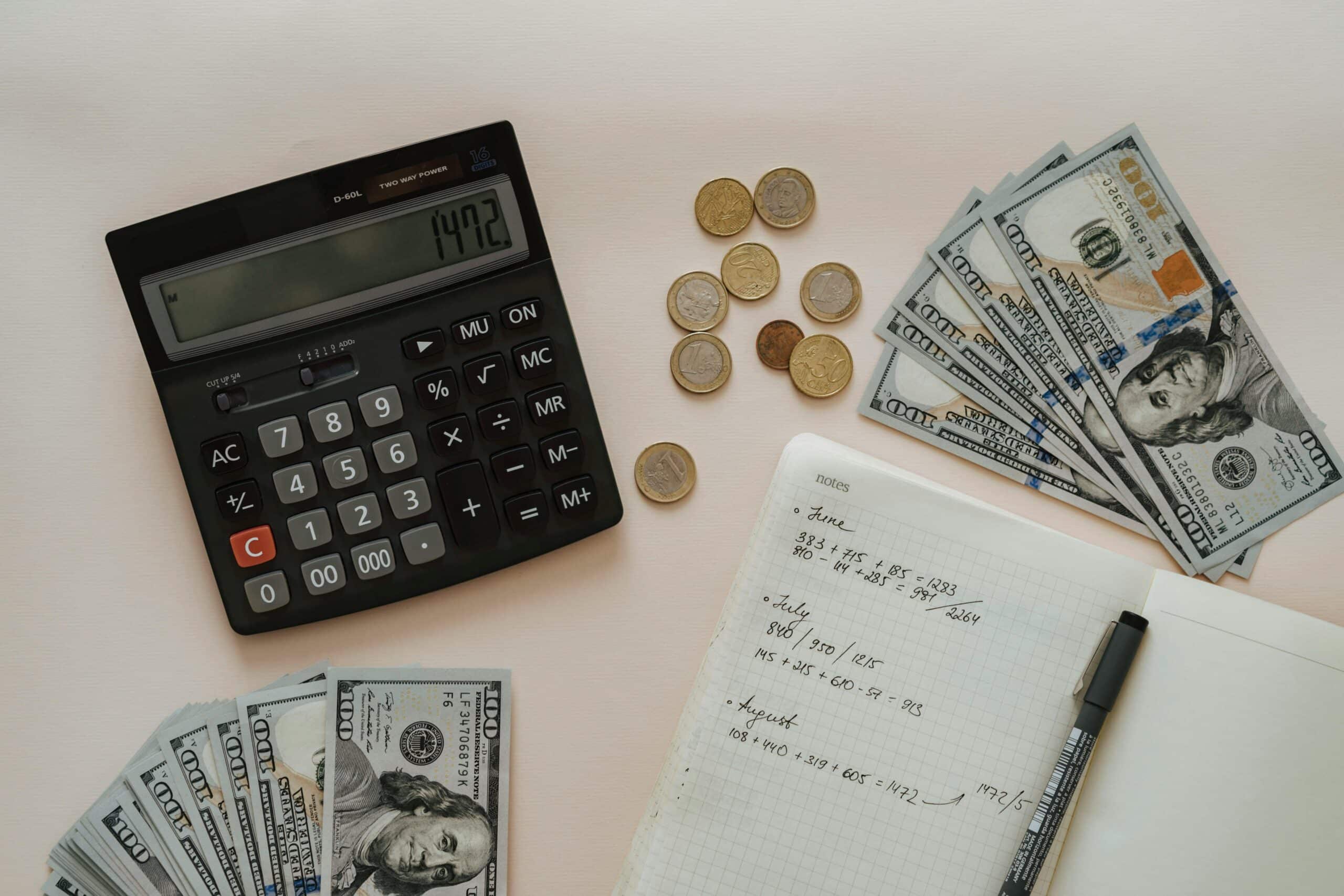

How is the Death Benefit Rate Calculated?

Death benefits under New Jersey’s Workers’ Compensation law is supposed to help families who have lost the income of workers who have died while on the job. Without these death benefits, the loss of a salary because of the work-related death of a family member for a household can be devastating. Many families would not be able to pay for basic living expenses such as housing and food. However, filing for these benefits may not be easy and straightforward. The deceased worker’s employer and their Workers’ Compensation insurance company may dispute the claim and fight against the paying of death benefits. Hiring an experienced Workers’ Compensation lawyer to file the claim might be necessary. Also, there are exceptions to the dependent rules, so hiring a lawyer to help would be a wise first step.

The death benefit rate is 50 percent of the deceased worker’s wages if there is just one dependent. For each additional dependent thereafter, the rate increases five percent until the total amount of death benefits paid to all dependents equals 70 percent of the deceased workers’ wages. However, there is a maximum weekly benefit amount that is modified every year. No matter how much money the deceased worker earned, the dependents will not receive more than the maximum weekly amount.

Mount Laurel Workers’ Compensation Lawyers at Kotlar, Hernandez & Cohen, LLC Fight for the Rights of Injured Workers and Their Families

If you have been injured at work, you may have many questions and be concerned about how to pay your bills and take care of your family. The surviving dependents of an employee who died of a work-related illness deserve assistance as well. The Mount Laurel Workers’ Compensation lawyers at Kotlar, Hernandez & Cohen, LLC are here to help you. Our experienced legal team will be able to answer all of your questions and help you file a claim for the benefits you deserve. Call us at 856-751-7676 or contact us online for a free consultation. Our offices are located in Mount Laurel, Cherry Hill, Trenton, and Vineland, New Jersey; and Trevose, Pennsylvania. We serve clients throughout New Jersey and Pennsylvania.