Gig work has become a significant part of the U.S. economy. Workers that offer rides, food delivery, services, or tasks for hire often engage in work facilitated by companies such as Uber, Lyft, DoorDash, TaskRabbit, and the like. Recent lawsuits and legislative efforts have attempted to address the lack of available worker protections through these giant companies, one of which is Workers’ Compensation, a benefit that provides insurance coverage to workers hurt on the job.

Unfortunately, many gig workers are unaware of the ways in which companies make money from their labor without providing appropriate protections. This arrangement too often comes to a head when a work-related accident makes it clear to the injured worker that they are on their own to deal with the consequences of the dangers presented by the work they do.

How Is the Gig Economy Putting Workers at Risk?

Whether gig workers are picking up some extra cash from a side hustle or they depend on these platforms for full-time work, the implications for the overall market are vast. Many additional types of gig work have sprung up in recent years, including cleaning services, moving help, repair work, and office assistance. The market for these freelance arrangements has changed the landscape of the economy, particularly for the workers who rent their services through mobile apps or website platforms.

Several gig work platforms have been accused of taking advantage of these workers by utilizing their work to make a profit without offering traditional worker benefits, such as sick time, unemployment, employer-based health insurance, and Workers’ Compensation.

When it comes to Workers’ Compensation specifically, the effect is that the giant corporation is essentially offloading all the costs of work accidents onto the worker, taking none of the responsibility for the potential risks that are central to their business model.

How Are Gig Companies Getting Away with These Policies?

The argument used by gig-work companies such as Uber is that the workers who sign up to provide rides or other services through these apps knowingly enter an employment arrangement that considers them independent contractors, as opposed to traditional employees.

Under the assumption that these workers are accepting work on a freelance basis from one assignment to the next, the companies are making the case that these workers are to be seen as independent contractors. This arrangement, by their definition, alleviates any responsibility on the part of the company to provide benefits that are traditionally extended to workers. Those perks, they argue, are a feature of more traditional jobs that constitute a true employer-employee relationship.

Why Are Some Workers Considered Employees and Others Considered Independent Contractors?

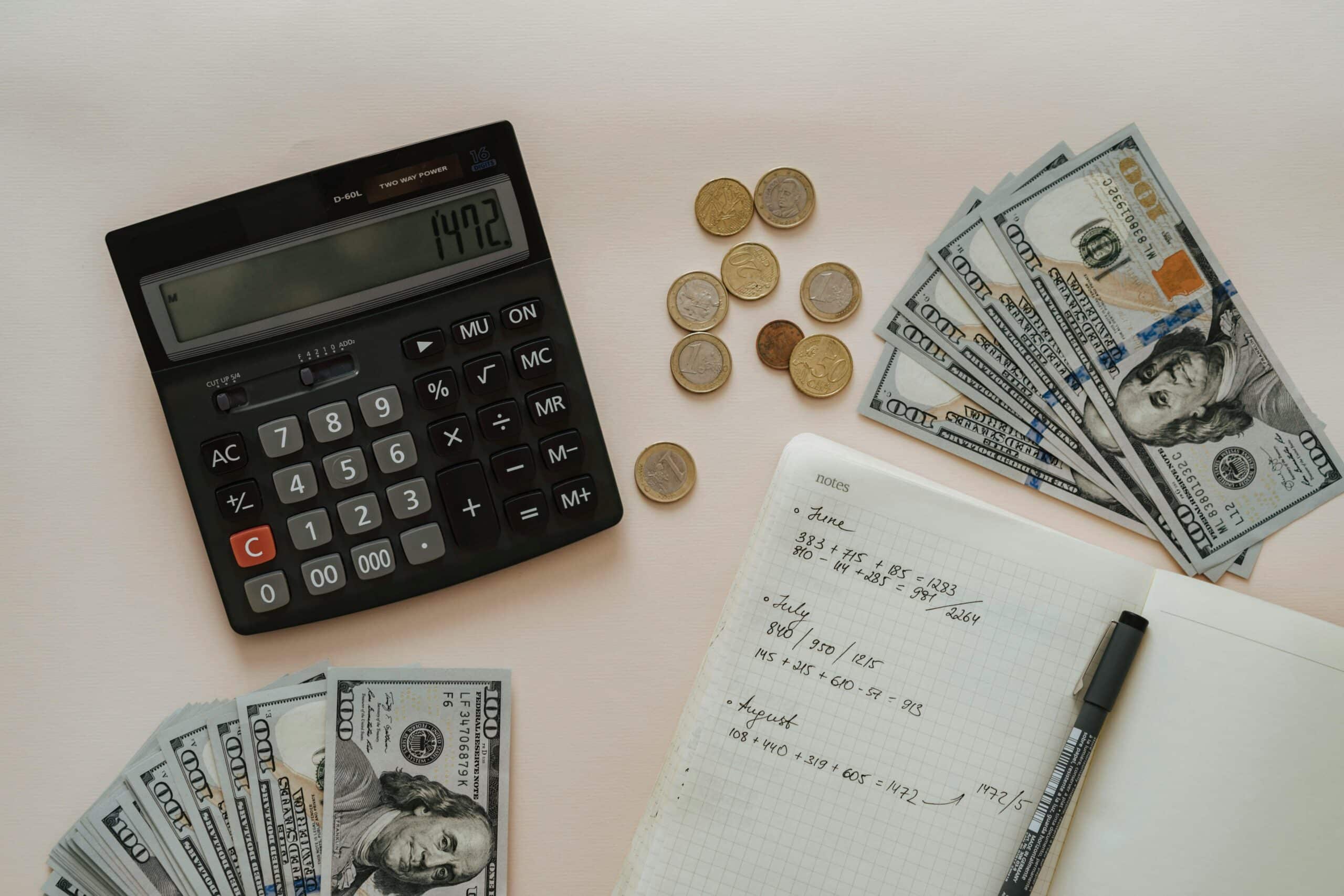

Large gig-economy companies have a specific interest in pushing the idea that their workers are independent contractors. Some companies that facilitate gig work may classify their employees mistakenly, whereas others may knowingly be attempting to avoid the costs of worker benefits such as Workers’ Compensation.

If it can be proved that the worker is a bona fide employee of the company, the employer becomes responsible for certain obligations to the employee, one of which is Workers’ Compensation coverage that provides protections in the case of a work-related injury.

What Job Characteristics Distinguish between an Independent Contractor and a Legitimate Employee?

Fortunately, there is a way to differentiate true independent contractors from legitimate employees, which is to make the determination by looking at what kind of control the employer has over the worker.

For example:

- Does the worker set their own schedule and determine their own hours?

- Is the worker responsible for providing the tools to do the job?

- Does the employer impose control over the manner in which the work is done?

- Does the employer determine when and where the work takes place?

- Can the employer dictate the method of payment?

- Does the employer have the right to terminate the worker?

- What laws exist to address the lack of protections for gig workers?

The issue of how to define and treat gig workers has been raging in the courts for years. In some areas, such as Minnesota, laws protect a worker’s right to Workers’ Compensation whether they are considered to be an independent contractor or an employee.

The most high-profile case involves the state of California, which limited the ability for companies to classify gig workers as independent contractors. This fight took on Uber, Lyft, and DoorDash and has resulted in legislative changes to the ways companies are able to classify their workers.

A 2018 California ruling determined that a worker is an employee if:

- The company controls the work

- The work performed is integral to the business model of the company

- The worker is not in business for themselves doing the type of work they perform for the company

This ruling involved a case that was concerned with gig-work wages, specifically whether the law should entitle gig workers to minimum wage and overtime standards. However, the ruling’s implications for worker designations inadvertently took on the issue at the heart of the question over Workers’ Compensation as well, providing a defined mechanism to view the controversy.

Are There Any Protections for Independent Contractors?

Since the controversy erupted, many large companies have created policies to offer protections to their independent contractor workers. These protections are voluntary, and they almost never meet the legally mandated protections afforded to official employees. Still, some companies do offer benefits for medical costs or lost wages to independent contractors.

New Jersey Workers’ Compensation Lawyers at Kotlar, Hernandez & Cohen, LLC Help Gig Workers Who Seek Coverage in the Wake of a Work Accident

If you are a gig worker who became injured on the job, you may be able to collect Workers’ Compensation. The New Jersey Workers’ Compensation lawyers at Kotlar, Hernandez & Cohen, LLC can prove that your work should qualify you as an employee, as opposed to an independent contractor, so you can claim Workers’ Compensation benefits through your employer. Call us at 856-751-7676 or contact us online for a free consultation. Our offices are in Mount Laurel, Cherry Hill, Trenton, and Vineland, New Jersey; and Trevose, Pennsylvania. We serve clients throughout New Jersey and Pennsylvania.